As a business coach or consultant, you may find yourself living in challenging times.

With more and more people entering the coaching and consulting space, it feels like it’s getting increasingly difficult for many to stand out and charge premium rates for your services.

You might even be feeling frustrated. There are just so many business owners that could benefit from your expertise, yet how exactly do you attract the ones who actually want your help and who are willing to pay for it

What feels even more frustrating at times is that as a business coach or consultant, reaching out for help yourself may feel at odds with the work you do. After all, if you’re so great at business, why would you have any challenges yourself?

Wait a minute. This is 100% normal. Just like a surgeon shouldn’t operate on him/herself, the same is true here. It’s exceedingly difficult to work on our own businesses – no matter how great we are. After all, as the saying goes, “The cobbler has no shoes!”

If you continue reading, you’ll discover a solution ahead.

Sharon Hayes Founder,

ProfitMancer.com

Sharon Hayes

The Challenges for Business Coaches and Consultants

Over the last two years, I’ve had conversations with literally hundreds of business coaches and consultants in preparation for ProfitMancer’s launch. I wanted to know the answer to one very specific question: What challenges did they face in growing their businesses?

I gathered a lot of data. As unique as each individual was, so were the challenges they faced. But they all basically fell into 7 areas:

Getting new clients

Being able to easily close clients

Inconsistent revenue

Having a framework to work with clients

Charging premium rates in ultra competitive environment

The systems/tech side of it

Balancing time on getting new business and servicing new clients

What if there was a way to make all of this easier? A way to remove all of those challenges?

A Little Bit About Me

want to share a bit of my background. It will help you understand how the ProfitMancer Money Mastery program came together and why this is something I feel is important and is my legacy work.

I was raised by my grandparents. I grew up in a ghetto area of Montreal. A typical blue collar upbringing. Very much the work ethic of – get a good job, work hard, save up when you want to buy something and don’t borrow money. My grandparents never owned their own home. They never stepped foot on a plane. They didn’t even graduate high school. Needless to say, we didn’t have a lot of money. It was always make do with what we did have. Although they started a small business when I was in my teens, I really didn’t grow up in an environment where finance and business were really talked about.

But I knew I wanted more in life. From the time I was 7 or 8 years old, I read a lot. At least 200 books every year. They showed me the possibilities of what life could be like.

One thing that my grandparents did instill in me was the importance of education. They always encouraged me to do my best, work hard and do what I could so that I could advance.

Change started for me in my first year of university. I was in engineering. I was the only female in most of my engineering classes. Misogyny was real. But more than that, I really was bored. What we were learning felt like it was behind where the world was. I had a mentor at the time. A successful businessman who I was helping write a memoir. He told me, “Sharon, why would you want to waste your time studying engineering? If you understand business and money, you can always hire an engineer to create what you want.”

I listened to him and switched to a different university and into business school. I majored in finance, focused on investment management and investment banking. To be clear, this wasn’t an entrepreneurial track!

While in business school, I ended up starting my first business. It was a subscription program and catalog of audio books in the field of personal development. It went unbelievably well. In my first year, I did about 750,000 in sales and 250,000 in profit. In today’s dollars, that translates to about 1,8m in sales and 600,000 in profit. Really, given how little I actually knew about starting or running a business, in retrospect, it’s kind of surprising.

But here’s the thing: I had no idea that starting a business was supposed to be hard. I had no idea of the high failure rate of start-ups. All I knew was that I had a dream – a vision for what I wanted to create – and then I went after it.

I focused on a couple of marketing methods. I set my pricing so that profits were guaranteed. I got creative with equipment – bought it at a bankruptcy sale – and studio time – bartered my time. I didn’t create any product before I had actual orders. I negotiated licensing rights to content that meant I only paid money if the content actually sold.

Since that time, I’ve built or been part of the growth of more than 40 different businesses both in the physical as well as the digital world. I got started on the Internet with a financial newsletter called “All About Money” in January, 1998. Within 3 short months, I was able to grow my subscriber base to over 65,000 readers and $20,000 a week in revenue. Although I ended up selling that business, I still own business ventures in the personal finance space. Otherwise, most of my current business interests are in supporting other businesses and health and wellness.

Through the years, I’ve had successes like helping build a chain of stores to $150m in revenue. I’ve sold multiple businesses for 7+ figures. Business owners I’ve mentored have gone to their own 7 and 8 figure businesses.

I’ve worked with people from all different walks of life. I’ve now worked with a dozen billionaires in some capacity.

It’s not always been easy. A lot of what I’ve learned has come from my own errors in judgment and mistakes.

As I get ready for my own next stage of life, I wanted to create Money Mastery as my legacy work. A way that I could pull together what I’ve learned in business, in business finance, in personal finance and in the field of personal development to help more business owners.

I think for a lot of reasons, people make all of this just so much harder than it really needs to be. So my aim is to simplify that for those that want more in life. I believe that if we – this means you as a business coach or consultant – can help others, it will be like a butterfly effect – causing ripples throughout the world.

You see I believe at the heart of it, we’re all given a big purpose to be here on this earth. What would it be like if all the dreamers and innovators of the world could focus more of their time on fulfilling their purpose rather than being caught up in all the rest of it? It all starts with the money.

Let’s help make the world a better place one client at a time!

The Challenges for Business Coaches and Consultants

As much as I spoke with business coaches and consultants to see what they were struggling with, I did the same with business owners. Countless conversations. Some weeks I spoke to as many as 20 different business owners. It gave me a lot of insight.

Business owners repeatedly shared the same big challenges:

A feeling of isolation

Learning was focused on “doing” versus “leading”

Lack of life balance

Lack of a feeling of freedom

Overwhelm

Uncertainty over the next step

I set out to solve this by creating the Money Mastery program and by creating a very specific structure to the delivery of it.

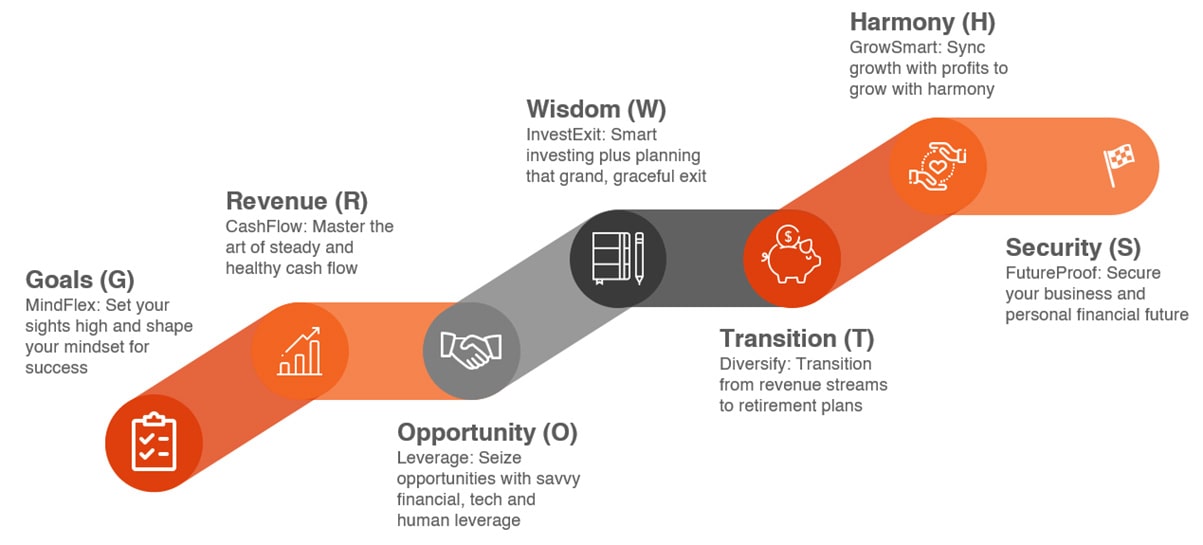

Money Mastery: The GROWTHS Framework

At the heart of the Money Mastery program is our GROWTHS framework. This symbolizes the growth and success that the program aims to achieve for its participants and how you’d be able to help your own clients.

The “GROWTHS” framework provides a holistic view, emphasizing continuous growth and the harmonious balance needed for long-term success and security in business.

How Money Mastery Will Be Delivered

The real magic will be in the delivery of the Money Mastery program.

The primary way to deliver Money Mastery is through cohorts, small groups of 5-20 business owners with either revenue or industry in common. This will allow business owners with common goals facing similar challenges to have a shared experience going through the program and gain even more insight and perspective as a result.

Money Mastery can also be delivered through 1:1 work with a coach or consultant that will work through each relevant topic of the program with the client.

Money Mastery Pricing

- $2,000 Application Fee

- $20,000 if prepaid (less the deposit)

- $1,000 per month for 24 months

The Money Mastery Certification: Your Unique Opportunity

Want to help your business coaching and consulting clients use the Money Mastery framework AND get guidance on exactly how AND support to help YOU succeed along the way?

The Money Mastery Certification is exactly what you need. With the Money Mastery Certification program, you will:

Have a roadmap of exactly what clients should learn and when in order to make a lasting impact

Never be stuck on how to help a coaching or consulting client in a myriad of different topics ever again

Get actionable tips and strategies that you can not only apply to your clients' businesses but yours as well

Have the freedom to use the full Money Mastery program or pick and choose the best topics to focus on with your clients

Gain a source of coaching and consulting clients by hosting one or more cohorts (with a potential of up to $9,000 earned per client!)

3 Ways You Can Leverage the Money Mastery Certification

Having multiple ways to utilize your certification will help empower you to enter exactly the client relationships you want and have everything you need and nothing you don’t in order for your clients to succeed.

Here are the different opportunities we’re providing:

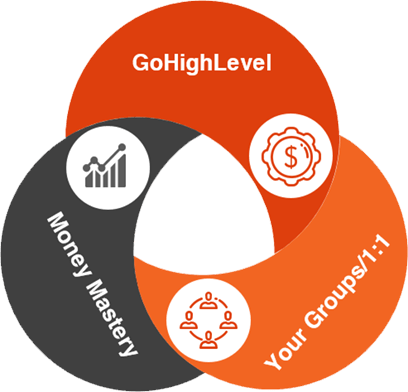

Cohort + 1:1 Through ProfitMancer

Have a roadmap of exactly what clients should learn and when in order to make a lasting impact

GoHighLevel for Your Own Groups or 1:1 Work

Want your own dashboard that not only serves up Money Mastery to your clients, but gives freedom to add your own additional content in and manage calls and communications more easily

A La Carte

See some elements to help clients with from the Money Mastery program while others would be unnecessary? A La Carte will allow you to pick and choose how you use Money Mastery for maximum results

How the Certification Solves Those 7 Key Problems for Business Coaches & Consultants

Remember those 7 challenges outlined earlier? With the Money Mastery Certification, handling those challenges can be done with ease.

Here’s how the certification makes a difference:

Struggles Getting New Clients:

You’ll be able to attract prospective clients by helping them succeed in a comprehensive way, and cohorts may also deliver you clients

Inability to Easily Close Clients:

You’ll more easily close clients by making a no-brainer offer of Money Mastery plus any add-on services you provide

Inconsistent Revenue:

As each client can mean substantial revenue without significant 1:1 time, either immediately or over time, your revenue can stabilize

Having to Develop a Framework:

There’s no need to invent a new wheel - use our GROWTHS framework and know that your client will have what they need to succeed

Difficulty Charging Premium Rates:

With being able to deliver tremendous value via Money Mastery, which itself has premium rates associated with it, you’ll be able to charge more

Managing Challenging Systems/Tech:

You won’t need to manage many different systems/tech for your clients to get the training that will help them thrive at a pace that works

Balancing Getting Business and Servicing Clients:

The scalable cohort model maximizes impact while ensuring a balance between growing and servicing your client base

Exploring Opportunity #1: Cohort + 1:1 Through ProfitMancer

Cohorts will be categorized by different revenue levels and different industries, and you have the opportunity to earn revenue in these ways:

Referring Participants to Cohorts

Earn 40% referral commission ($4,000/year) for referring a new participant to a cohort, whether a cohort led by you or someone else.

Facilitating a Cohort

Earn 35% ($3,500/year) per participant for facilitating a cohort, whether the participants of that cohort were referred by you or not.

Referring Participants to Your Cohort

Combine the above to earn 75% ($7,500/year) per participant you refer to a cohort you're facilitating.

Plus Additional Revenue from 1:1

Augment your earnings by offering participants in your cohort the ability to book 1:1 sessions with you seamlessly within our system. Receive 75% of all sessions booked.

Exploring Opportunity #2: GoHighLevel for Your Own Groups or 1:1 Work

Want to provide Money Mastery to your own groups or 1:1 clients combined with your own materials and with functions to help you manage over the necessary calls and communications?

Upon completing the certification, you’ll have an opportunity for a nominal additional cost to get your own GoHighLevel frontend and backend site created with pages adapted to suit your needs.

This allows you to more fully create your own immersive experience for your clients and combine your own relevant teachings in with the Money Mastery materials to more fully transform each client’s business.

Once you complete your certification, we would be in touch to discuss next steps and if this may be right for you.

Exploring Opportunity #3: A La Carte

While Money Mastery was built to be all-encompassing, not every lesson will be pertinent to every type of business or for every business owner’s situation.

Rather than overwhelm clients with everything in Money Mastery including the irrelevant-to-them materials, pick and choose which topics make the most sense to include or not include for them.

This can allow you to still take advantage of this already-built framework while tailoring it to meet your clients’ real needs.

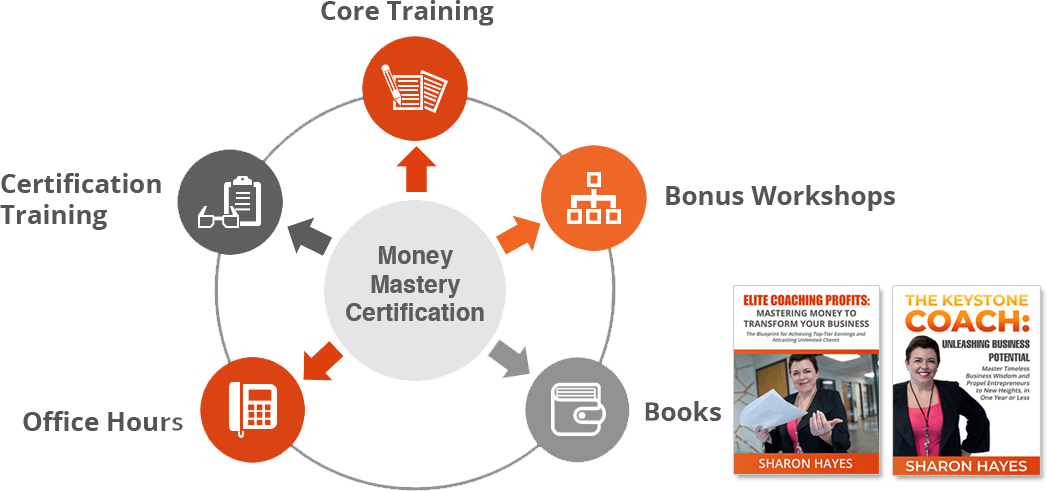

What the Money Mastery Certification Gives You and Why

Explore what is in store for you with the Money Mastery Certification and why each piece of the puzzle is vital for your ability to make the best use this framework thrive:

Core Training (Value: $x)

Total Value: $x

Bonus Workshops (Value: $x)

Total Value: $x

Certification Training (Value: $x)

Total Value: $x

Books (Value: $x)

Total Value: $x

Office Hours (Value: $x)

Total Value: $x

July Public Cohort Release Certification Price

$10,000

Current Cohort Starting April 15th

Order Now For Only

$5,000

Maximum Capacity: 20 People